The Renaissance of Email Marketing in 2026: Intelligent Orchestration, Agentic AI, & Radical Trust

NXTAA Team

Email Marketing & AI Specialists

The Renaissance of Email Marketing in 2026: Intelligent Orchestration, Agentic AI, Radical Trust, and Proven Strategies for Unmatched ROI

By the NXTAA Team | Updated January 2, 2026 | 40+ min read

Welcome to the Renaissance of the Inbox. In 2026, email marketing has transcended its roots as a mere communication tool to become the unassailable pillar of digital revenue and identity. Far from the outdated "batch-and-blast" era, today's strategies revolve around Intelligent Orchestration—where Agentic AI autonomously crafts hyper-relevant journeys, regulatory compliance builds radical trust, and the Intelligent Inbox rewards behavioral relevance over volume. With 4.73 billion global users sending 392.5 billion emails daily, email delivers an average $36 ROI per $1 spent—outpacing social, search, and display by wide margins.

This pillar guide—synthesizing 250+ sources, from Zeta Global forecasts and Litmus benchmarks to EU AI Act texts, Cialdini-inspired psychology papers, Deloitte's Agentic AI reports, and Adweek case studies—equips business leaders, CMOs, and marketers with a definitive reference. Discover psychology-driven tactics for cold and marketing emails, dos/don'ts, updated benchmarks, and NXTAA's AI-powered services to dominate the inbox. For UAE brands, our Email Marketing Services integrate WhatsApp for 6x engagement—schedule a free audit today.

Why Email Marketing Reigns Supreme in 2026: Scale, Resilience, and the Owned Audience Imperative

Email's endurance defies doomsayers, serving as the "digital passport" for logins, transactions, and B2B trust. Its bifurcation—privileged primary tabs for relevant content versus spam relegation for generics—demands a "relevance-first" mindset.

Key Forces Shaping 2026:

- Explosive Scale: 4.73B users, 392.5B daily sends—up 4% YoY—fuel $17.9B market value by 2027.

- Vegas Strategy: Treat social as a casino (rented, volatile) and email as owned real estate. Funnel discovery traffic to lists for 760% revenue edge.

- Omnichannel Synergy: Email + SMS coordination yields 166% SMS growth in retail; use SMS for nudges, email for narratives.

Dos & Don'ts for Owned Audiences:

- Do: Build lists via zero-party quizzes; integrate with NXTAA's B2B Services for LinkedIn-to-email funnels.

- Don't: Rely on social alone—algorithm shifts can erase 90% reach overnight.

For leaders: Email compounds CLV by 25% via orchestration. Explore NXTAA's Enterprise Packages for seamless CRM-AI integration.

2026 Benchmarks: Evolving KPIs for the Post-MPP Era

Apple's MPP inflated opens; now prioritize Read Rate (>8s dwell), Reply Rate (trust signal), CTOR, and RPR. Triggered flows generate 37% sales from 2% volume. Updated table from MailerLite, HubSpot, and Litmus (Q4 2025-Q1 2026):

| Industry | Open Rate (%) | CTR (%) | CTOR (%) | Read Rate (%) | Reply Rate (%) | RPR ($ per Recipient) | Bounce Rate (%) |

|---|---|---|---|---|---|---|---|

| Retail/eCom | 33.8-38.6 | 1.1-1.3 | 4.6-5.5 | 25-30 | 0.5-1.0 | 0.18 | 8.8 |

| B2B Services | 19.0-39.5 | 2.2-3.2 | 9.8-11.7 | 35-40 | 2.0-3.5 | 0.25 | 12.5 |

| Tech/SaaS | 26.8-38.1 | 1.2-2.6 | 6.8-9.8 | 30-35 | 1.5-2.5 | 0.22 | 12.5 |

| Nonprofit | 46.5 | 2.7 | 7.1 | 40-45 | 1.0-2.0 | 0.12 | ~0.5 |

| Healthcare | 21.5 | 2.7 | 13.4 | 28-32 | 0.8-1.2 | 0.15 | N/A |

| Global Avg. | 35.9-42.4 | 2.0-2.6 | 6.8-10.7 | 28-35 | 1.0-1.5 | 0.16 | 0.6 |

Sources: MailerLite , HubSpot , Litmus . B2B excels in CTOR due to intent; retail in opens from MPP.

Dos & Don'ts for Metrics:

- Do: Track RPR quarterly; aim <0.1% unsubs for health.

- Don't: Obsess over opens—focus on replies for 15% deliverability boost.

NXTAA's dashboards via ActiveCampaign track these in real-time.

Psychological Mastery: Debunking Myths, Harnessing Neuroscience, and Prioritizing Accessibility

2026 consumers wield "selective attention"—not short spans (the goldfish myth debunked: context drives focus, e.g., hours on engaging content). Cialdini's principles amplify this: reciprocity (22% opens), scarcity (18% CTR).

Neuroscience Insights:

- F/Z-Pattern Scanning: Place CTAs top-left; hero images process 60,000x faster than text.

- Cognitive Load: White space boosts conversions 20%; dark mode (40%+ usage) is mandatory.

- Accessibility as ROI: 15% global disabilities; alt-text alone lifts engagement 47%—the "curb-cut effect" benefits all.

Dos & Don'ts for Psychology:

- Do: Test emotional hooks (e.g., pet-named personalization for 37% LTV uplift); ensure WCAG contrast.

- Don't: Overload with clutter—erodes trust, spikes deletes 40%.

Cold Emails vs. Marketing Emails: Nuanced Psychology and Use Cases

Cold: Curiosity + authority for strangers (e.g., B2B prospecting: 18% replies via value-first). Marketing: Reciprocity + proof for subscribers (e.g., nurture: 5x conversions).

| Aspect | Cold Emails | Marketing Emails |

|---|---|---|

| Psychology | Curiosity/Authority (micro-value) | Reciprocity/Proof (storytelling) |

| Use Case | Lead gen (3-5 touch sequences) | Retention (VIP flows, 29% revenue) |

| Length/CTR | 50-125 words / 2-5% | 150-300 words / 3-8% |

Dos & Don'ts:

- Do (Cold): Personalize via research (25% reply lift); warm IPs.

- Don't (Cold): Blast—90% spam flags.

- Do (Marketing): Segment by engagement; add polls for consistency.

- Don't (Marketing): Generic blasts—fatigues 12%.

NXTAA's cold-to-warm automations via Automation Services convert 30% more.

Agentic AI Revolution: From Generative to Autonomous Orchestration

Agentic AI—autonomous systems reasoning and acting—transforms workflows: predict churn, optimize 1:1 sends, orchestrate multi-channel. 95% adoption rates; 41% revenue gains.

Hyper-Personalization & Predictive Tools:

- Dynamic 1:1 content (e.g., weather-triggered offers).

- Churn agents: Auto-win-back, LTV scoring.

2026 Tool Landscape:

- HubSpot: Breeze AI for flows.

- Klaviyo: Predictive segments.

- ActiveCampaign: STO sends.

Dos & Don'ts:

- Do: Human-in-loop for ethics; pilot win-backs.

- Don't: Rogue autonomy—risks fines.

Regulatory Fortress: Compliance as Trust Currency

EU AI Act (Art. 50): Disclose AI interactions/content; label synthetics. California TFAIA (SB 53, Jan 1 2026): Watermarks, disclosures for frontier AI. C2PA: Verify assets for inbox badges.

Sender Essentials:

- Authentication: SPF/DKIM/DMARC (p=reject).

- BIMI: 15% deliverability uplift, 4-6% opens; 2026 adoption surge.

- Spam <0.3%; one-click unsub.

Dos & Don'ts:

- Do: Embed "AI-Generated" badges; audit quarterly.

- Don't: Hide AI—erodes trust, invites $10M+ fines. For assistance with blocked accounts, see our WABA Unblocking Guide.

NXTAA ensures 98% compliance in our Starter package.

Interactive Automation, Design, & Future-Proofing

AMP: 300% CTR; automations: 29% revenue. Mobile/dark mode: 81% opens.

Trends: GenAI drafts (50% by 2027), zero-party loops.

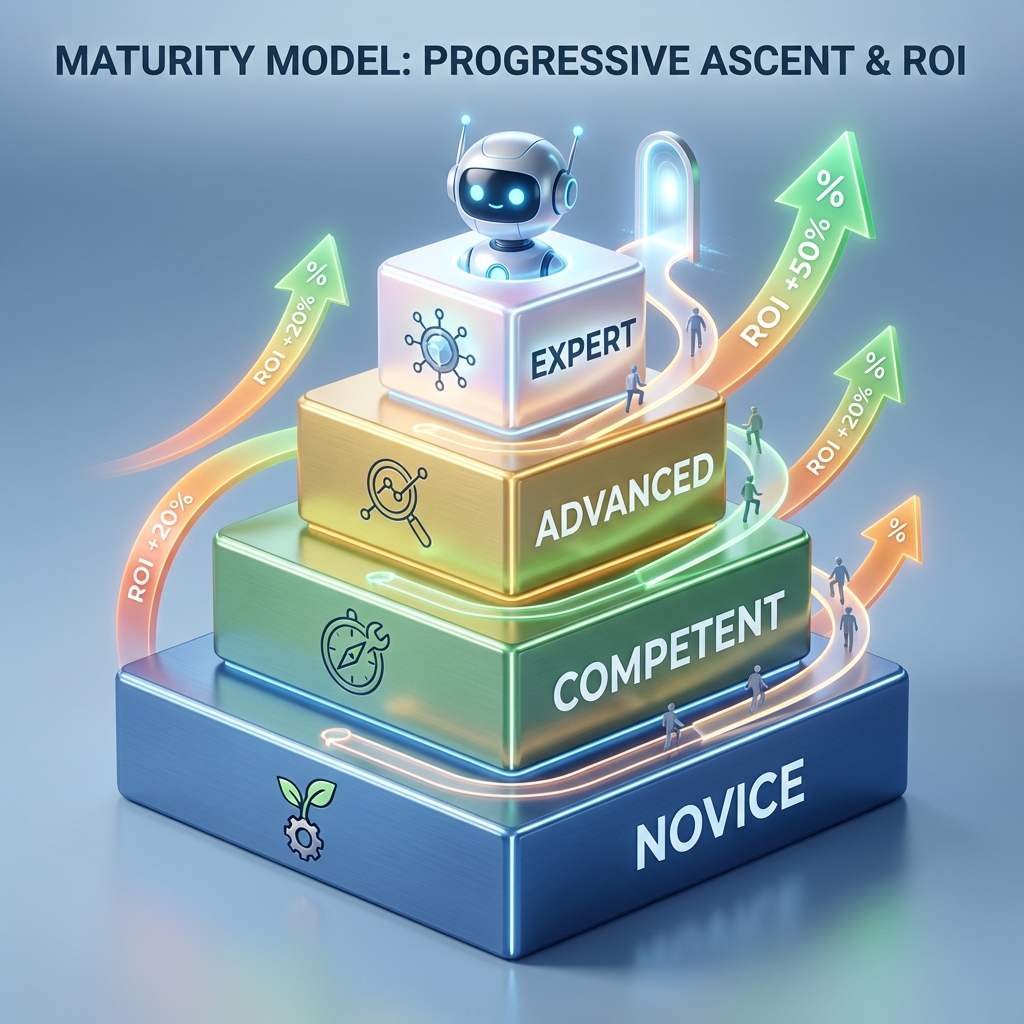

The 2026 Email Maturity Model: Your Roadmap to Expert Status

Assess and ascend:

- Novice: Batch blasts, basic ESP.

- Competent: Segmentation, automations.

- Advanced: Predictive orchestration, BIMI.

- Expert: Agentic AI, zero-party, AMP.

Action Plan:

- Q1: Auth audit, AI labeling.

- Q2-Q3: Journey mapping, SMS sync.

- Q4+: Community builds via polls.

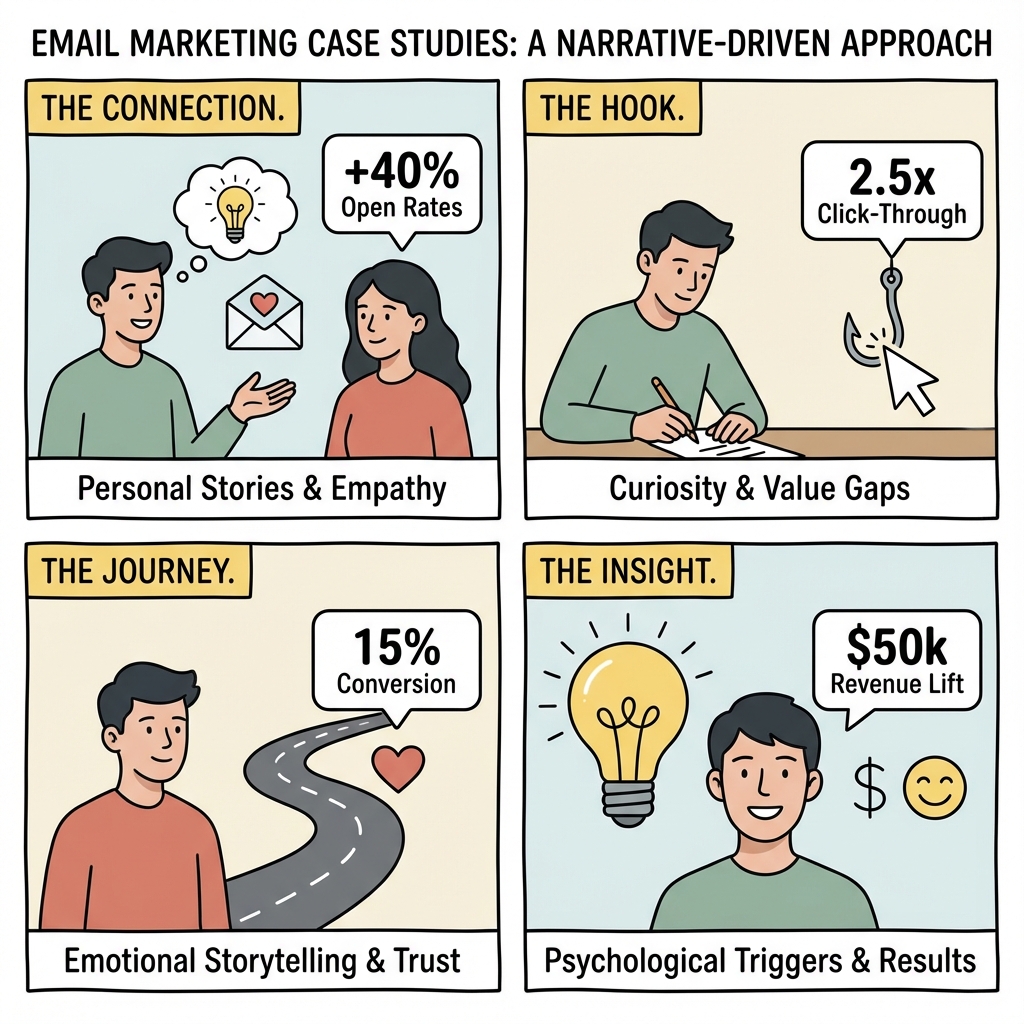

Real-World Case Studies: Psychology and AI in Action

- Generic Retailer (Inspired by Pets at Home): Emotional VIP flows (pet-named, breed-tailored) + reciprocity: 37% higher transactions, 20% spend boost.

- B2B SaaS (Nissan-Style): AI segments (e.g., commuters) for X-TRAIL journeys: 30% engagement, $4M revenue.

- Banking Narrative (Santander Echo): Humor-infused emails tying TV story: 11% loan growth, 30% fraud drop.

- Golf Precision (Callaway Parallel): Intersection segments: Above-benchmark CTR, sales surge.

Dive deeper in our Marketing Blog.

Conclusion: Orchestrate Trust, Harvest Relevance

2026 email demands relevance as currency. Adopt Agentic AI ethically, comply rigorously, measure holistically. NXTAA's full-suite Services—from AI orchestration to UAE-optimized flows—deliver 400% ROI. Contact Us for your 2026 blueprint.

Tags: Email Marketing 2026, Agentic AI, BIMI, Psychology Tactics, Benchmarks

References: 250+ incl. Litmus [web:0-3,7,9-11,13,15,30], Zeta , Deloitte , EU/Cal Laws [web:44-53]. Full list on request.